18

September

2012

IFC METROPOL held a conference for investors

On 13-14 September 2012, IFC METROPOL organized the first annual

conference for investors: “Beyond the Blue Chips: Growth and Value

in Russian equities.”

The main objective of the Conference is to open up opportunities

for the top managers of the leading Russian small and mid-equity

companies to tell investors about their market strategies, growth

potential and risks. The conference focused on two areas that

would, in the long run, drive investors’ interest in Russia –

growing domestic demand and infrastructure development.

Each day of the conference was opened with a plenary session

that included presentations by stock market experts, followed by

meetings of issuers and investors in the “face-to-face”

format.

Issuers were invited to the conference whose activities most

representatively demonstrate the potential of the sector in which

they work: Bank Saint Petersburg, Nomos-Bank, RBC Holding, Group

COX, M.Video, PIK Group, UTair, Rusagro, Globaltrans, Mostotrest,

Transcontainer, Sollers, HMS Group, Kuzbass Fuel Company, Nakhodka

Active Marine Fishery Base, IDGC of Center, IDGC of Center and

Volga region, IBS, Raspadskaya, Steppe Cement and Cherkizovo.

The conference attracted more than 60 investors representing

management companies, funds, banks, such as Troika Dialog,

Centrokredit Bank, CJSC Transfingrup, Bank Zenit, MC BCS, Softline,

Capital Growth Russia Fund, VTB Capital, MC Uralsib, Metropol

Global Partners Fund, Inventum Fund, East Capital, Danske Capital,

NCH Advisors, and others. During the two days of the conference,

over 200 meetings were held, in which each investor was able to

meet the issuer of its interest.

On the first day, September 13, the plenary session was opened by

Chief Executive Officer of IFC METROPOL Alexey Rodzyanko. He spoke

about his expectations of the Russian stock market and stressed

that during and after the crisis Russian companies had dropped out

of the spotlight of portfolio investors as risky assets. Small

second-tier companies were affected the most. Their quotes are

falling faster, while growing slower. This gap creates a potential

that will be realized in the near future, when the market is more

optimistic. He added that the IFC METROPOL conference is intended

to draw the attention of investors to such companies.

The next speaker was Anna Kuznetsova, Managing Director of the

Moscow Stock Market Exchange. She described the already completed

and ongoing projects on the site, aimed at creating more

comfortable conditions for stock trading, including companies with

low capitalization. After her speech, several investors asked Ms.

Kuznetsova questions.

Analytic Department Director of IFC METROPOL Mark Rubinstein

also gave an opening speech. He said: “The greatest growth

potential is seen in small and mid-cap companies. This segment is

key for our company; we are the leading experts in it and have one

of the most extensive research coverage of the market, to ensure

that our customers know and understand the sector well. The most

interesting investment topics in the sector are domestic demand and

infrastructure. We are confident that the popularity of these

issues will increase over time. The Russian market looks much

cheaper than its counterparts because of political risk perception.

We expect that this perception will gradually decline, and the

lower the discount is, the closer to its peers the market

assessment will be.”

Deputy Chairman of Central Bank Mikhail Sukhov also attended the

first day of the conference. He spoke about the situation in the

banking sector and the prospects for its development, stressing

that the banking sector shows high profitability and is quite

attractive for investors.

On 14 September the prospects for the growth of infrastructure

industries were discussed. The plenary session was opened by

Nikolay Osadchy, Head of Metal Courier. He described the situation

in the steel industry, the trends and the companies that are the

most attractive for investments, and presented forecasts of the

industry dynamics.

In its report on the second day of the conference, Mark

Rubinstein reiterated that the overall Russian market growth would

outperform its counterparts. Small and mid-cap companies, in turn,

will be ahead of the market average. This statement was illustrated

by comparing the indices of small and mid-cap companies with

average market indices in times of rapid growth of the market in

the near past.

The conference participants continued the discussion in the

lobbies. In general, they appreciated the relevance of the event

and its topics. IFC METROPOL plans to hold a conference for

investors every autumn, at the beginning of the business

season.

Alexey Rodzyanko, Chief Executive Director of IFC METROPOL,

and Anna Kuznetsova, Managing Director of the Moscow Stock Market

Exchange, on the conference opening day

Anna Kuznetsova’s speech

At the plenary session

During the round table discussion, participants touched upon

all the relevant issues

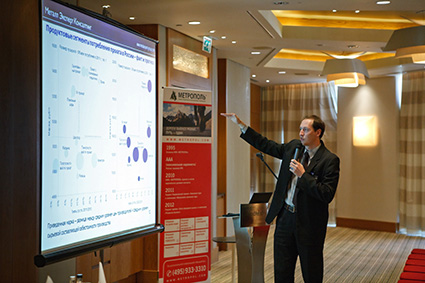

Report by Mark Rubinstein, Analytic Department Director of

IFC METROPOL

Report by Nikolay Osadchy, Head of Metal Courier

In the intervals between the meetings, the participants had

the opportunity to talk informally. Mark Rubinstein, IFC METROPOL,

and Konstantin Noskov, Bank Saint Petersburg